☒ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| Definitive Proxy Statement | ||

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Under Rule 240.14a-12 | |

☒ | No fee required. | |||

☐ | Fee paid previously with preliminary materials. | |||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

| 320 Park Avenue, New York, NY 10022 (212) 277-7100 |

Dear Stockholder,

2022

As we reflect on the past year, 2023 was a year markeddefined by disruptiongrowth and transformation. At EXL, we viewedcontinued evolution. The most significant development was EXL’s continued integration of emerging artificial intelligence (“AI”) technology into our longstanding data-led strategy. We achieved this as an opportunity. We developed innovative solutions to harness our clients’by unlocking key synergies between data and gain a competitive advantage. Their successes ledAI. To create better outcomes for our clients, we leverage our deep experience with data to employ AI in more reliable ways, and we use AI to refine and enrich our success.data. This integration of AI into our data-led strategy positioned us well for industry-leading performance over the past year and will continue to do so looking forward to 2024, our 25th anniversary year, and beyond.

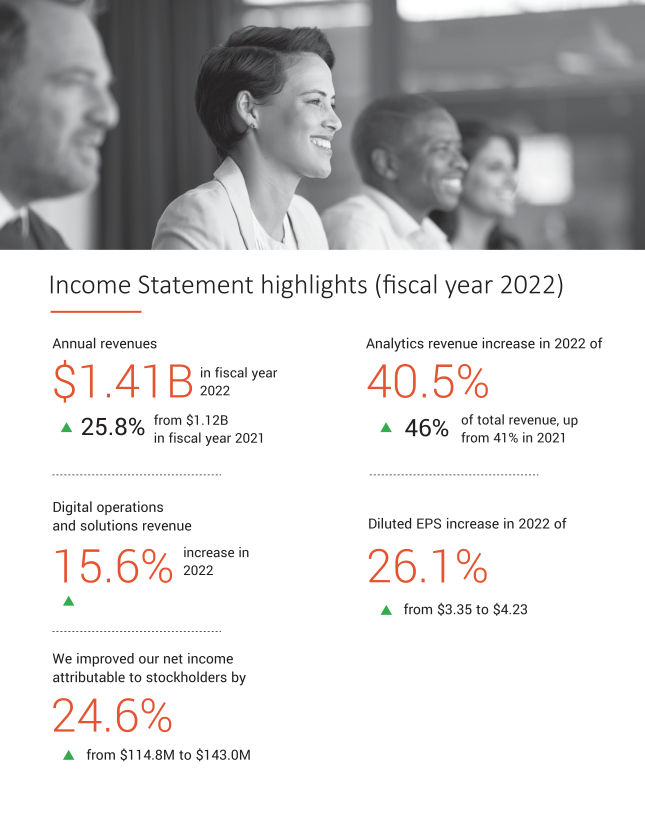

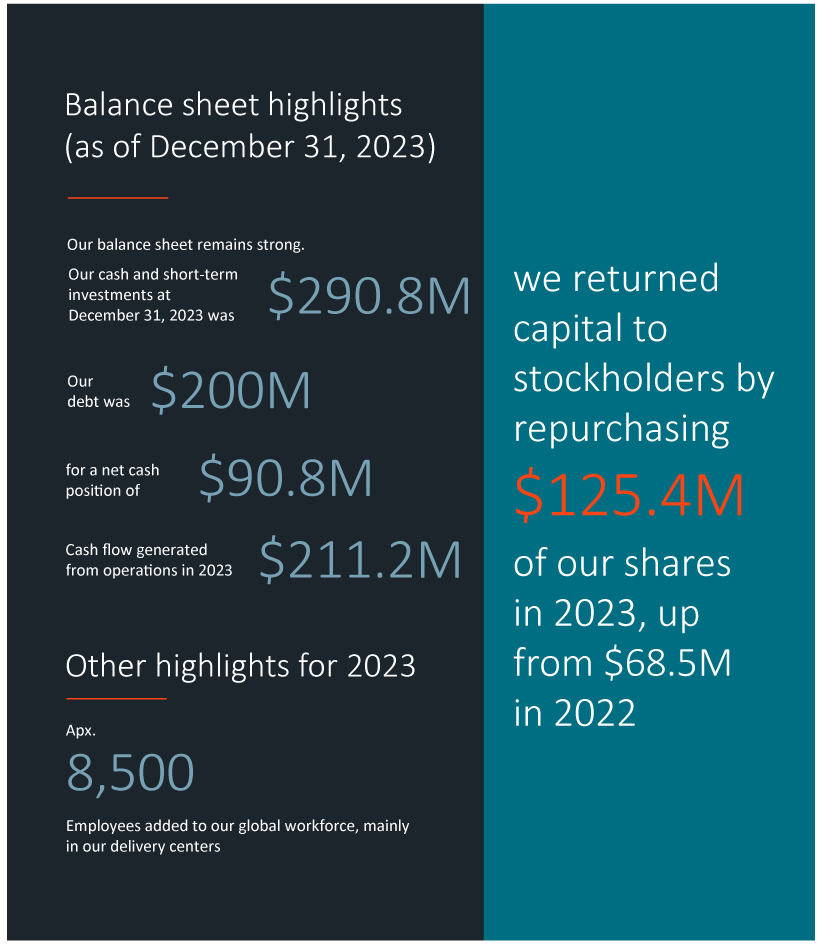

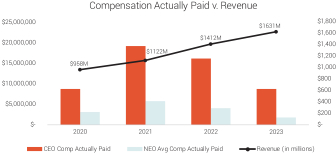

Our headline earnings numbers help tell part of thethat story. In 2022,2023, we generated strong growth across both Analytics and Digital Operations and Solutions. Our 20222023 revenue was 1.41$1.63 billion, representing growth of 26%16% over 2021.2022. We also grew adjusted EPS(1) to $6.02,$1.43, up 25%19% from $4.83$1.20 in 2021.

Our achievements in 2022 are rooted in our unique data-driven capabilities to improve our clients’ operations through digital solutions, enable better decision-making through advanced analytics, and embed intelligence in their workflows through machine learning, AI and automation. Every business today is being challenged to do more with less while customer expectations for speed, personalization and seamless integration continue to expand. EXL harnesses the power of data to help our clients meet those challenges. These data-driven efforts help our clients react faster, reduce costs and build stronger customer experiences. Going forward, we believe this strategy will continue to grow the success of our clients and our success.2022.

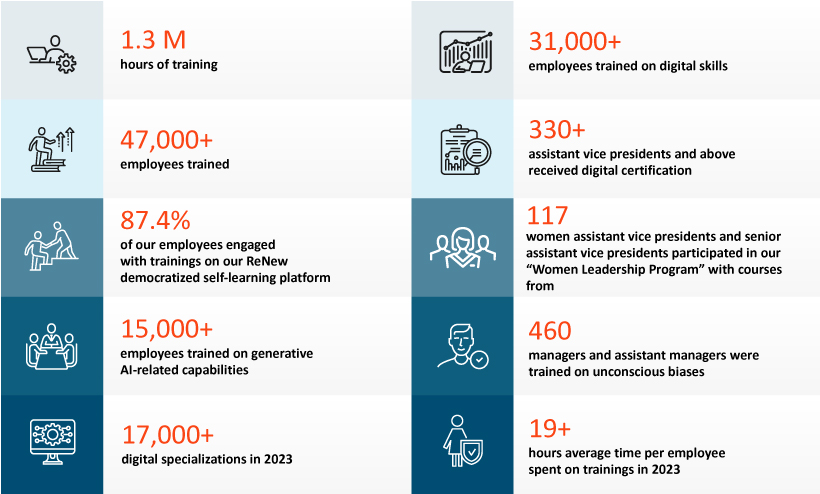

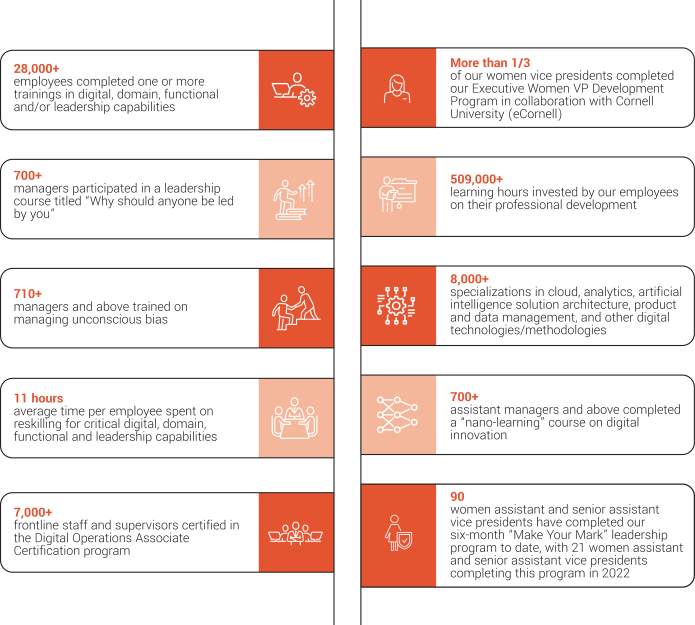

Our ability to executecontinue executing at this high level, despite fast-moving changes in technology and market dynamics, is the result of sound execution, our differentiated strategy, is a testament to our talentedbalanced portfolio of businesses and steadily growingour amazing team of more than 45,40050,000 people as well ascommitted to constant improvement. In 2023, we established an AI Center of Excellence with 1,500 specialists. Our employees spent 1.3 million hours training through our culturedemocratized self-learning platform, with more than a quarter of learning, diversity and experience. Our employees’ creativity and dedication allow EXL to meet market demand and keep pace with our clients’ evolving requirements. In 2022, our employees continued to enhance their expertise, collectively investingtaking advantage of AI training and development tools and more than 509,000 hours57% of our employees participating in developing their professionaldigital skills functional and leadership capabilities and domain expertise.training. We achieved more than 8,000 specializations across keydeveloped several generative AI applications for internal use in areas such as cloud, analyticsemployee self-service, recruiting and artificial intelligence solution architecture, among others.finance, and embedded AI into our core solutions. We now have more than 150 AI use cases, with over 30 deployments in production with go-live for 6 clients.

(1) Adjusted EPS is a non-GAAP financial measure. See “Non-GAAP Reconciliation” later in this proxy statement.

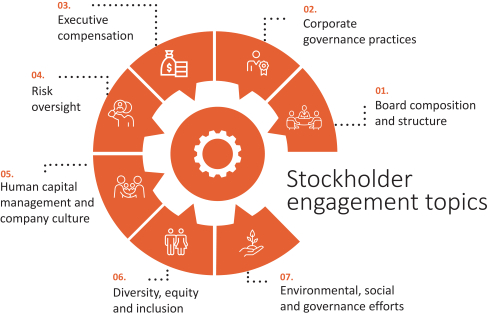

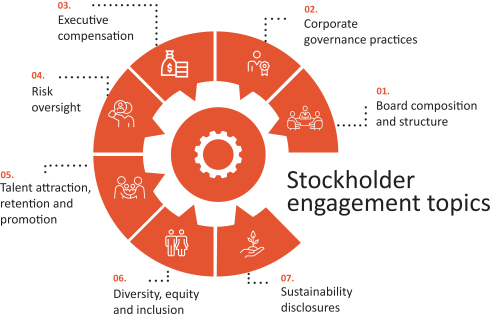

| EXL 2024 Proxy Statement | / |

This year’s Proxy Statement continues to highlighthighlights continued progress on our environmental, social and governance (ESG)sustainability efforts, which we view as integralcontribute to our corporate strategy. In 2022,business success. We have installed solar power projects at several of our centers in India and also transitioned several centers in India and the UK to renewable energy through open access arrangements, which has helped reduce our Scope 2 greenhouse gas emissions. We have continued our focus on diversity, equity and inclusion by developing diverse leadership and building an inclusive work culture where our employees are empowered to bring their authentic contributions, collaborate and drive innovation. Making good on our commitment to not only run a world class business, but to also support our people and the communities in which we made strides towardoperate, we significantly increased our transition to sustainable energy and gave back tocommunity engagement participation: EXL employees contributed more than 14,000 people in37,000 volunteer hours as part of our communities aroundcommunity engagement efforts, up approximately 22,000 hours from the world through volunteering inprior year, and more than 19,000 of our signatureemployees joined EXL-sponsored community engagement initiatives, Skills to Win and Education as a Foundation. We also helped our clients make their businesses more sustainable through the use of cloud services, digital operations and solutions resultingup from 7,000 participants in paper reduction and analytics to meet compliance and risk objectives. We continuously improve on our corporate governance – in 2022, by allocating formal oversight over ESG-related controls and disclosures to our Audit Committee, and by carrying through our board refreshment philosophy to promote the diversity of backgrounds, skills and professional experience among our directors necessary to oversee our evolving corporate strategy, while continuing to hold regular conversations with our stockholders on governance-related topics through our stockholder engagement program. 2022.

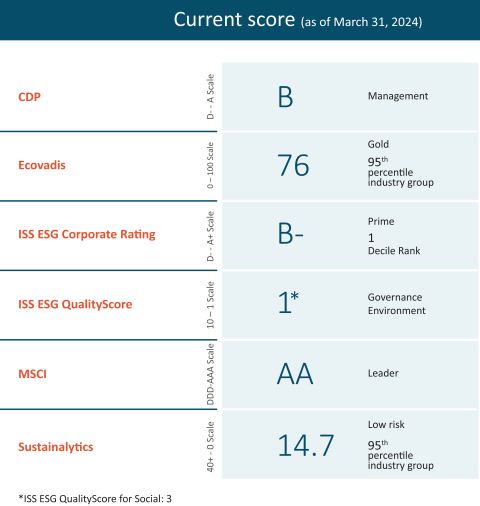

We are proud of this progress, and the external recognitions we received for these efforts, including for the secondfourth year as one of America’s Most Responsible Companies by Newsweek and Statista, Inc., and for the secondthird year as one of Barron’s 100 Most Sustainable Companies and a Gold rating from EcoVadis. You can read more about our commitment to ESG issuessustainability on our website, in our Sustainability Report and in the “Sustainability” section of this Proxy Statement.

|

Finally, we would like to thank Anne Minto and Clyde Ostler who will be retiring from our board of directors following our 2023 Annual Meeting of Stockholders. Anne served on EXL’s board for 10 years and Clyde has been on our board since 2007. Both have played key roles in guiding our company to its current position. We would also like to welcome Andreas Fibig, a seasoned global executive with a strong record of innovation across industries and geographies, who joined EXL’s board as an independent director in January 2023, and is standing for reelection at the 2023 Annual Meeting of Stockholders.

On behalf of the board of directors of ExlService Holdings, Inc., we are pleased to invite you to the 20232024 Annual Meeting of Stockholders, which will be held on June 20, 2023.2024. We look forward to sharing more about our Companycompany at the Annual Meeting. We encourage you to carefully read the attached 20232024 Annual Meeting of Stockholders and Proxy Statement, which contains important information about the matters to be voted upon and instructions on how you can vote your shares.

Your vote is important to us. Please vote as soon as possible whether or not you plan to participate in the Annual Meeting.

The board of directors and management look forward to your attendance at the Annual Meeting.

Sincerely,

|

| |||

Rohit Kapoor Chair and CEO | Vikram Pandit |

|

| / | EXL 2024 Proxy Statement |

Notice of 20232024 Annual Meeting of Stockholders

Dear Stockholder:

You are cordially invited to the 20232024 Annual Meeting of Stockholders of ExlService Holdings, Inc., a Delaware corporation (the “Company”), for the purposes of voting on the following matters:

| 1. | the election of |

| 2. | the ratification of the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for fiscal year |

| 3. | the approval, on a non-binding advisory basis, of the compensation of the named executive officers of the Company; |

| 4. | the |

| 5. |

|

|

the transaction of such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

We will hold our Annual Meeting in virtual format only, via live audio webcast (rather than at any physical location) on June 20, 20232024 at 8:309:00 AM, Eastern Time. Our virtual meeting platform will allow for full participation as if you were attending physically. You or your proxyholder may participate, vote, and examine our stockholder list at the Annual Meeting by visiting www.virtualshareholdermeeting.com/EXLS2023EXLS2024 and using your 16-digit control number.

If you are a stockholder of record at the close of business on April 21, 2023,23, 2024, the record date for the Annual Meeting, you are entitled to vote at the Annual Meeting. A list of stockholders as of the record date will be available for examination for any purpose germane to the Annual Meeting, during ordinary business hours, at the Company’s executive offices at 320 Park Avenue, 29th Floor, New York, New York 10022, for a period of 10 days prior to the date of the Annual Meeting and at the Annual Meeting itself.Meeting. If our corporate headquarters are closed during the 10 days prior to the Annual Meeting, you may send a written request to the Corporate Secretary at our corporate headquarters, and we will arrange a method for you to inspect the list. The list of stockholders will also be available during the Annual Meeting at www.virtualshareholdermeeting.com/EXLS2023.

Please note the technical requirements for virtual attendance at the Annual Meeting, as described in the enclosed Proxy Statement beginning on page 128122 under the heading “Annual Meeting Q&A.”

Pursuant to rules promulgated by the Securities and Exchange Commission, we are providing access to our proxy materials over the Internet. On or about April 28, 2023,29, 2024, we will mail a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) to each of our stockholders of record and beneficial owners at the close of business on the record date. On the date of mailing of the

|

Internet Notice, all stockholders and beneficial owners will have the ability to access all of the proxy materials on a website referred to in the Internet Notice. These proxy materials will be available free of charge.

Whether or not you expect to attend the Annual Meeting, the Company encourages you to promptly vote and submit your proxy (i) by Internet (by following the instructions provided in the Internet Notice), (ii) by phone (by following the instructions provided in

| EXL 2024 Proxy Statement | / |

the Internet Notice) or (iii) by requesting that proxy materials be sent to you by mail that will include a proxy card that you can use to vote by completing, signing, dating and returning the proxy card in the prepaid postage envelope provided. Voting by proxy will not deprive you of the right to attend the Annual Meeting or to vote your shares. You can revoke a proxy at any time before it is exercised by voting at the Annual Meeting, by delivering a subsequent proxy or by notifying the inspector of elections in writing of such revocation prior to the Annual Meeting. YOUR SHARES CANNOT BE VOTED UNLESS YOU EITHER (I) VOTE BY USING THE INTERNET, (II) VOTE BY PHONE, (III) REQUEST PROXY MATERIALS BE SENT TO YOU BY MAIL AND THEN USE THE PROXY CARD PROVIDED BY MAIL TO CAST YOUR VOTE BY COMPLETING, SIGNING AND RETURNING THE PROXY CARD BY MAIL OR (IV) ATTEND THE ANNUAL MEETING AND VOTE.

By Order of the Board of Directors

Ajay Ayyappan

Executive Vice President, General Counsel and Corporate Secretary

New York, New York

April 28, 202329, 2024

|

2023 Proxy Statement

Table of contents

/ | EXL |

Table of contents

| 1 | ||||

| 13 | ||||

| 25 | ||||

| 44 | ||||

| 57 | ||||

| 60 | ||||

| 60 | ||||

| 83 | ||||

| 84 | ||||

| EXL 2024 Proxy Statement | / |

20232024 Proxy Statement summary

20232024 Proxy Statement summary

Summary

Below is a summary of select components of this Proxy Statement, including information regarding this year’s stockholder meeting, nominees for our board of directors, summary of our business, performance highlights and selective executive compensation information. This summary does not contain all of the information that you should consider prior to submitting your proxy, and you should review the entire Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 20222023 (the “2022“2023 Form 10-K”). We refer to the fiscal year ended December 31, 20222023 as “fiscal year 2022,2023,” “fiscal 2022,2023,” and “2022.“2023.” Unless otherwise indicated, all prior period information has been adjusted to reflect the 5-for-1 forward stock split of our common stock effected in August 2023.

Meeting agenda, voting matters and recommendations*

| Voting proposal item |

| Board vote recommendation | ||

1. Election of directors |  | FOR the election of each nominee (pg. | ||

Required vote: Affirmative vote of a majority of votes cast

| ||||

2. Ratification of appointment of independent registered public accounting firm |  | FOR (pg. | ||

Required vote: Affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote

| ||||

3. Advisory (non-binding) Say-on-Pay vote to approve executive compensation |  | FOR (pg. | ||

Required vote: Affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote

| ||||

4. |  | |||

| ||||

|  | FOR (pg. | ||

Required vote: Affirmative vote of a majority | ||||

|  | |||

| ||||

* Virtual attendance at our Annual Meeting will constitute presence in person for purposes of quorum and voting at the Annual Meeting. | ||||

| EXL 2024 Proxy Statement | / | 1 |

Annual meeting information | ||||

| Time and date: | |||

June 20, | ||||

| Record date: | |||

| April | ||||

| Place: | |||

| Virtual format only via live audio webcast | ||||

| Voting: | |||

Stockholders as of the

| ||||

Voting methods | ||||

| Internet (pre-meeting): | |||

| www.proxyvote.com | ||||

| Mail: | |||

Follow instructions on the Internet notice | ||||

| Phone: | |||

| Call the number listed on the Internet notice | ||||

| Electronically: | |||

| Attend the Annual Meeting and vote electronically | ||||

If you are the beneficial owner of shares held in the name of a brokerage, bank, trust or other nominee as a custodian (also referred to as shares held in “street name”), your broker, bank, trustee or nominee will provide you with materials and instructions for voting your shares. See page

| ||||

|

20232024 Proxy Statement summary

Our business

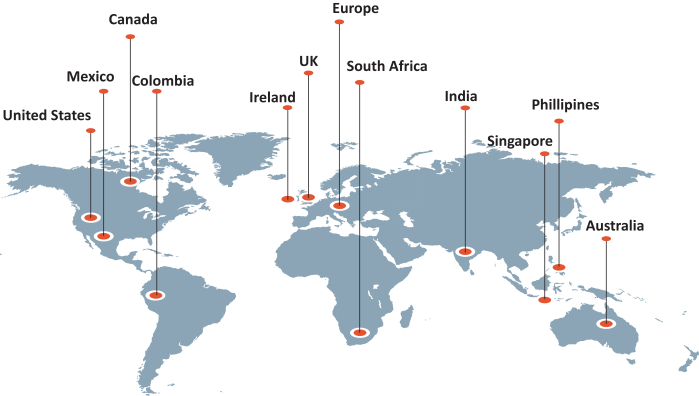

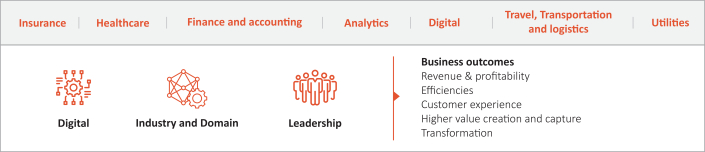

We are a leading data analytics and digital operations and solutions company that partnerscompany. We partner with clients using a data and AI-led approach to improvereinvent business models, drive better business outcomes and unlock growth. By bringing together deep domain expertisegrowth with robustspeed. EXL harnesses the power of data, powerful analytics, cloud, artificial intelligence (“AI”), and machine learning (“ML”), we create agile, scalable solutions and execute complexdeep industry knowledge to transform operations for the world’s leading corporations in industries including insurance, healthcare, banking and financial services, media and retail, among others. Focused on driving faster decision making and transforming operating models, EXL was founded onin 1999 with the core values of innovation, collaboration, excellence, integrity and respect. HeadquarteredWe are headquartered in New York, our team is over 45,400 strong, with more than 50 officesand have approximately 54,000 employees as of December 31, 2023, spanning six continents.

| Company 3 year performance | ||||||||||||||||||||||||||||||||||||||||||||||||

| Company’s three year performance | ||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue (Year-over-year growth %) | Revenue (Year-over-year growth %) | |||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by segment information ($ in millions) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by segment information ($ in millions) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by segment information ($ in millions) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by segment information ($ in millions) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by segment information ($ in millions) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by segment information ($ in millions) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by segment information ($ in millions) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by segment information ($ in millions) | 2020 YOY% | 2021 YOY% | 2022 YOY% | 2021 YOY% | 2022 YOY% | 2023 YOY% | ||||||||||||||||||||||||||||||||||||||||||

Insurance | $341.8 | -1.3% | $382.0 | 11.8% | $448.7 | 17.5% | $382.0 | 11.8% | $448.7 | 17.5% | $529.9 | 18.1% | ||||||||||||||||||||||||||||||||||||

Healthcare | 101.2 | 4.0% | 112.4 | 10.9% | 97.4 | -13.4% | 112.4 | 10.9% | 97.4 | -13.4% | 106.0 | 8.9% | ||||||||||||||||||||||||||||||||||||

Emerging Business | 152.7 | -19.7% | 167.2 | 9.5% | 218.6 | 30.7% | 167.2 | 9.5% | 218.6 | 30.7% | 265.7 | 21.5% | ||||||||||||||||||||||||||||||||||||

Analytics | 362.7 | 1.5% | 460.7 | 27.0% | 647.3 | 40.5% | 460.7 | 27.0% | 647.3 | 40.5% | 729.1 | 12.6% | ||||||||||||||||||||||||||||||||||||

Consolidated | $958.4 | -3.3% | $1,112.3 | 17.1% | $1,412.0 | 25.8% | $1,112.3 | 17.1% | $1,412.0 | 25.8% | $1,630.7 | 15.5% | ||||||||||||||||||||||||||||||||||||

/ | EXL |

20232024 Proxy Statement summary

| EXL | / | |

20232024 Proxy Statement summary

/ | EXL |

20232024 Proxy Statement summary

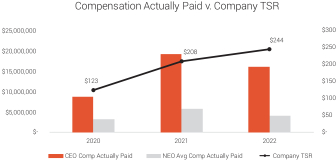

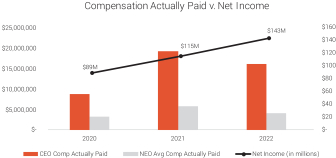

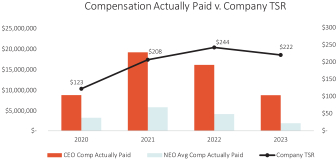

Total stockholder return

The graphs below compare our 1-year, 3-year and 5-year cumulative total stockholder return (“TSR”) as of December 31, 20222023 with the median TSR for companies comprising Nasdaq, S&P 600 and our peer group.

1-Year TSR

| 3-Year TSR

| 5-Year TSR

|

| EXL | / | |

20232024 Proxy Statement summary

Corporate governance highlights

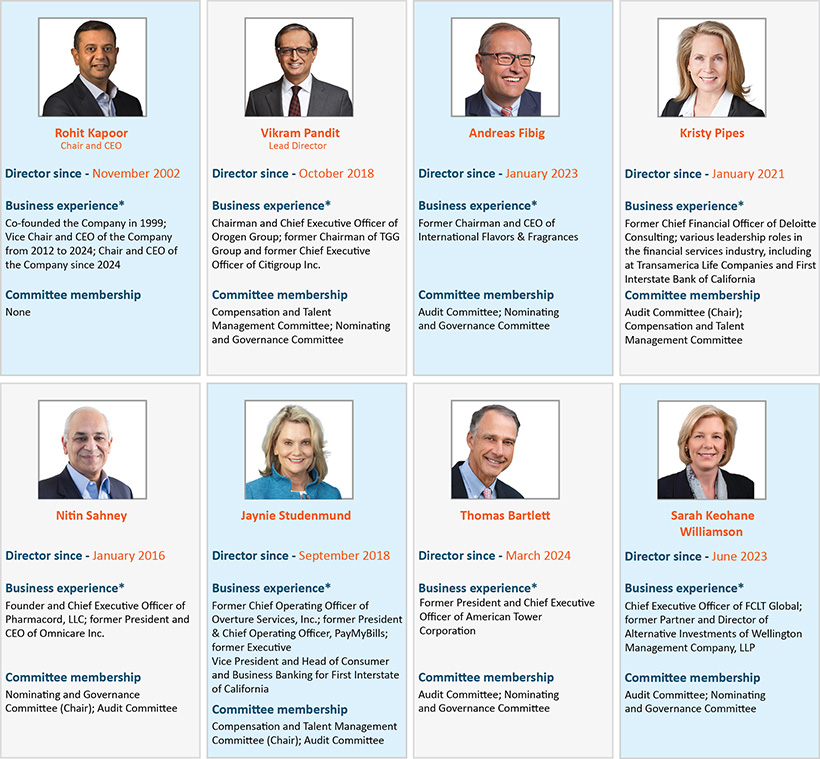

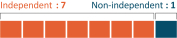

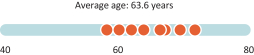

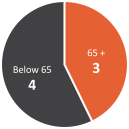

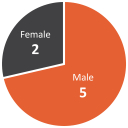

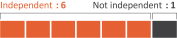

The following information is based on our board profile immediately following our Annual Meeting (assuming the election of our seveneight director nominees), and reflects current board practices.

/ | EXL |

20232024 Proxy Statement summary

| EXL | / | |

2023 Proxy Statement summary

Nominees for election as directors

since | membership | |||||

| 2018 |

| ||||

| 2002 |

| ||||

|

| |||||

| 2013 |

|

| |||

| 2021 |

|

| |||

| 2016 |

| ||||

| 2018 |

| ||||

| ||||||

|

20232024 Proxy Statement summary

Director nominees - skills matrix

Our director nominees review and indicate whether they are experts in each of the skills and areas of experience listed below. An “expert,” for purpose of the skills set forth in this skill matrix, means an individual who, based on career experience (other than as an EXL director), has developed and continues to maintain comprehensive knowledge and command over the subject matter, including relevant updates. Definitions for each of these skills, as well as a description for how these are considered for candidates for directors, can be found under “Director Qualifications” beginning on page 29 of this Proxy Statement.

|  |  |  |  |  |  |  |  |  |  |  | |||||||||||||

| Finance and accounting | Executive leadership | Public company governance | Analytics | Human capital management | Digital operations and solutions | Marketing | Global experience | Risk oversight and management | Information and cyber security | ESG | Mergers acquisitions | |||||||||||||

Vikram Pandit | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||

Rohit Kapoor | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

Thomas Bartlett | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||

Andreas Fibig | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||

| ||||||||||||||||||||||||

Kristy Pipes | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||

Nitin Sahney | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||

Jaynie Studenmund | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||

Sarah K. Williamson | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||

| 8 | / | EXL 2024 Proxy Statement |

2024 Proxy Statement summary

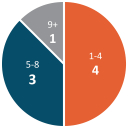

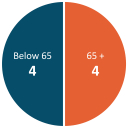

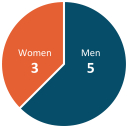

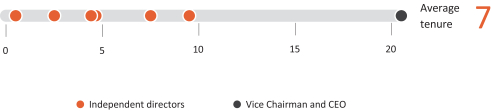

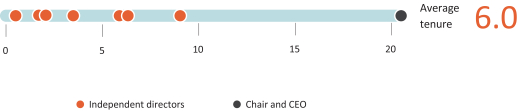

Board statistics*

Board tenure

| Gender diversity

|

|

| Racial and ethnic diversity

| Age distribution

| ||||||

| ||||||||

Board independence

* Following our Annual Meeting, assuming election of all nominees

| EXL | / | |

20232024 Proxy Statement summary

Our purpose and core values

| 10 | / | EXL 2024 Proxy Statement |

2024 Proxy Statement summary

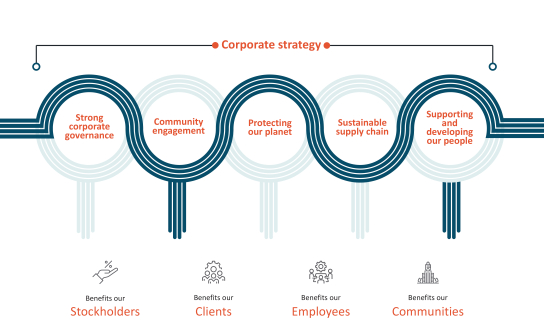

Sustainability

At EXL, we believe that there is always a better way; we look deeper, find it, and make it happen. This purpose informs our corporate culture, which, in turn, is rooted in our five core values. In line with our purpose, values and culture, we are committed to finding a better way through sustainability initiatives that are key toaligned with our long-term corporate strategy and designed to benefit our stockholders, clients, employees, communities and communities.manage expectations and commitments across various stakeholder groups. See “Sustainability” beginning on page 4844 below for more details on our recent accomplishments in sustainability.

|

2023 Proxy Statement summary

2022 Compensation highlights

Named Executive OfficersOverview

|

| |

|

| |

|

| |

|

| |

|

| |

2022 Standard annual compensation

| Compensation component | Rohit Kapoor | Maurizio Nicolelli | Vikas Bhalla(3) | Vivek Jetley | Ankor Rai | |||||||||||||||

| Salary | $766,384 | $483,822 | $265,432 | $440,164 | $420,082 | |||||||||||||||

| Non-equity incentive plan compensation | 1,829,887 | 554,929 | 357,340 | 525,488 | 481,822 | |||||||||||||||

| Equity awards (1) | 8,356,213 | 1,810,865 | 1,964,960 | 1,862,689 | 1,553,192 | |||||||||||||||

| Other compensation (2) | 58,423 | 9,654 | 38,432 | 9,654 | 9,654 | |||||||||||||||

| Total | $11,010,906 | $2,859,270 | $2,626,165 | $2,837,996 | $2,464,750 | |||||||||||||||

(1) Equity award values reflect equity grants in 2022 based on the grant date fair value of awards in accordance with FASB ASC Topic 718.

(2) For each named executive officer, this category includes, if applicable, his perquisites and personal benefits, hiring bonus, changes in pension value, Company-paid life insurance premiums and Company contributions to our 401(k) plan. A detailed discussion of the compensation components for each named executive officer for fiscal year 2022 is provided in the “Summary compensation table for fiscal year 2022” beginning on page 87.

(3) Mr. Bhalla is based in India. Certain of his compensation components, as described herein, are paid in Indian rupees (INR), and are converted for comparison purposes at 82.72 INR to 1 U.S. Dollar (USD), which was the exchange rate on December 30, 2022.

On an annual basis, we submit to our stockholders a vote to approve, on a non-binding advisory basis, the compensation of our named executive officers as described in this Proxy Statement. We refer to this vote as “say-on-pay”. Please refer to our Compensation Discussion and Analysis, beginning on page 63 for a complete description of our 2022 compensation program.

Below are a few highlights of our executive compensation:

| • | Compensation philosophy: Our executive compensation philosophy is focused on |

|

2023 Proxy Statement summary

| • | Over |

| • | Annual incentive program |

| – | Company-wide metrics (75%)—Revenue and adjusted operating profit margin (“AOPM”) |

| – | Individual metrics (25%)—Linked to areas of performance that are specific to each executive |

In 2023, we achieved 100.6% of our revenue performance target, and 101.4% of our AOPM target resulting in annual incentive payout calculations for our named executive officers, ranging from 113% of target performance to 133% of target performance. |

| EXL 2024 Proxy Statement | / | 11 |

2024 Proxy Statement summary

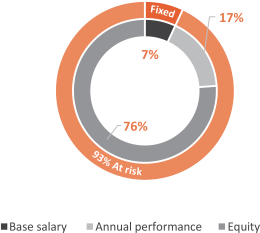

| • | Long-term equity incentive program: We also continued our equity incentive program, which |

In 2023, we also granted |

|

|

| • | Compensation Policies. Our compensation program is designed to reflect appropriate governance practices aligned with the needs of our business, and includes, among others, the following features: robust clawback policy; robust stock ownership guidelines; limited perquisites; no excise tax gross-ups; and an anti-hedging and anti-pledging policy. See “Executive compensation program, practices and policies” beginning on page 65 below. |

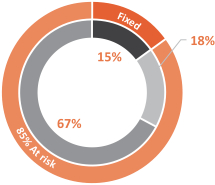

Compensation mix

Chair & CEO compensation mix | NEO compensation mix (Excluding Chair & CEO) | |

| ||

* Base salary also includes items included in “All Other Compensation” in the Summary Compensation Table on page 84.

/ | EXL |

2023 Proxy Statement summary

Compensation mix

|

| |

|

|

* Base salary also includes other compensation

|

Our board of directors

Our board of directors

Our board of directors currently consists of nine directors (including our seveneight director nominees, and twoone of our directors who currently serveserves on the board, but will not stand for reelection)re-election) with diverse experience, including in analytics, digital operations and solutions, client industries, information and cybersecurity, human capital management, ESG,sustainability, and finance and accounting, among others.

From top left: Clyde Ostler* (Independent Director), Nitin Sahney (Independent Director and Nominating and Governance Committee Chair), Kristy Pipes (Independent Director and Audit Committee Chair), Rohit Kapoor (Vice Chairman and CEO),Andreas Fibig (Independent Director) Jaynie Studenmund, (Independent Director and Compensation and Talent Management Committee Chair), Andreas Fibig

From bottom left: Sarah K. Williamson, (Independent Director) , Rohit Kapoor (Chair and CEO), Vikram Pandit (Independent Chairman)(Lead Director), Som MittalMittal* (Independent Director), Anne Minto*. Not pictured: Thomas Bartlett (Independent Director)

* Not standing for reelectionre-election

| EXL 2024 Proxy Statement | / | 13 |

Our board of directors

Board diversity matrix

2024 Board diversity matrix (as of April 29, 2024)*

Total number of directors: | 9 | |||

| Female | Male | |||

| Part I: Gender identity | ||||

Directors | 3 | 6 | ||

| Part II: Demographic background | ||||

Asian | — | 4 | ||

White (other than Middle Eastern) | 3 | 2 | ||

* Includes our nine current directors, including our eight nominees for election at the Annual Meeting.

2023 Board diversity matrix (as of April 29, 2023)

Total number of directors: | 9 | |||

| Female | Male | |||

| Part I: Gender identity | ||||

Directors | 3 | 6 | ||

| Part II: Demographic background | ||||

Asian | — | 4 | ||

White (other than Middle Eastern) | 3 | 2 | ||

/ | EXL |

Our board of directors

Board diversity matrix

2023 Board diversity matrix (as of April 28, 2023)*

Total number of directors: | 9 | |||

| Female | Male | |||

| Part I: Gender identity | ||||

Directors | 3 | 6 | ||

| Part II: Demographic background | ||||

Asian | — | 4 | ||

White (other than Middle Eastern) | 3 | 2 | ||

* Includes our nine current directors, including our sevenDirector nominees for election at the Annual Meeting

Upon the recommendation of our Nominating and Governance Committee, we are pleased to propose eight of our existing directors as nominees for election as directors at the Annual Meeting. As previously disclosed, one of our current directors, Mr. Mittal, will not be standing for re-election at the Annual Meeting; the remaining eight directors are our director nominees at the Annual Meeting.

2022 Board diversity matrix (asThe following tables provide a summary of April 28, 2022)our board composition by tenure, age, gender and independence immediately after our Annual Meeting (assuming the election of all nominees).

Total number of directors: | 9 | |||

| Female | Male | |||

| Part I: Gender identity | ||||

Directors | 3 | 6 | ||

| Part II: Demographic background | ||||

Asian | — | 4 | ||

White (other than Middle Eastern) | 3 | 2 | ||

| Board tenure | Age distribution | Gender diversity | Board independence | |||

|  |  |  | |||

| ||||||

* Following our Annual Meeting, assuming election of all nominees

| EXL | / | |

Our board of directors

DirectorOur nominees for election at the Annual Meeting

Upon the recommendation of our Nominating and Governance Committee, we are pleased to propose seven of our existing directors as nominees for election as directors at the Annual Meeting. As previously disclosed, two of our current directors, Ms. Minto and Mr. Ostler, will not be standing for re-election at the Annual Meeting; the remaining seven directors are our director nominees at the Annual Meeting.

The following tables provide a summary of our board composition by age, gender, tenure and independence immediately after our Annual Meeting (assuming the election of all nominees).

|  |  |  | |||

Our nominees for re-election as directors at the Annual Meeting are as follows:

| Rohit Kapoor |

| Vikram Pandit

| |||

| Thomas Bartlett Independent Director |

| ||||

| Andreas Fibig Independent Director |

|

| |||

| Kristy Pipes Independent Director and Chair of the Audit Committee |

| Nitin Sahney Independent Director and Chair of the Nominating and Governance Committee | |||

| Jaynie Studenmund Independent Director and Chair of the Compensation and Talent Management Committee |

| Sarah K. Williamson Independent Director | |||

We believe that our director nominees, and continuing directors, individually and together as a whole, possess the requisite skills, experience and qualifications necessary to maintain an effective board to serve the best interests of the Company and its stockholders described below under “Director qualifications” (see pages 34-35).beginning on page 29.

/ | EXL |

Our board of directors

The name, age (as of the date of this Proxy Statement), principal occupation and other information, including the specific experience, qualifications, attributes or skills that led to the conclusion that such person should serve as a director of the Company, with respect to each of the nominees, are set forth below. There are no family relationships among any of our directors or executive officers.

Nominees for election at the Annual Meeting - Biographical information

|

|

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

| ||||||

* Audit committee financial expert under applicable SEC rules and regulations

|

Our board of directors

Rohit Kapoor Director since November 2002 | (since 2008) | Non-independent |

|

Age:

Committees: N/A

Business experience at the Company

• Chair and CEO (2024 - present) • Vice

• President and CEO (2008 - 2012)

• Various senior leadership roles, including CFO and COO (2000 - 2008)

Other business experience • Business head, Deutsche Bank, a financial services provider (1999 - 2000)

• Various capacities at Bank of America in the United States and Asia, including India (1991 - 1999)

• Lead independent director, director and member of the audit committee, CA Technologies, Inc. (NASDAQ: CA), a software services company (2011 - 2018)

• Member, Board of Directors, American India Foundation (AIF)

• Member, Board of Directors, Pratham (Tristate Chapter) | ||||||

SKILLS | |||||||

| Finance and accounting | ||||||

| Executive leadership (within the last 5 years) | ||||||

| Public company governance | ||||||

| Analytics | ||||||

| Human capital management | ||||||

| Digital operations and solutions | ||||||

| Marketing | ||||||

| Global experience | ||||||

| Risk oversight and management | ||||||

| Mergers and acquisitions | ||||||

| EXL 2024 Proxy Statement | / | 17 |

Our board of directors

Vikram S. Pandit Director since October 2018 | Lead Director since 2024 (Chair of Board from 2022 - 2024) | Independent |

| Age: 67 — is Chairman and Chief Executive Officer of The Orogen Group, which makes significant long-term strategic investments in financial services companies and related businesses. Mr. Pandit’s business experience, skills and directorships are detailed below. The Company has concluded, based in part on Mr. Pandit’s more than 30 years of experience in the financial services industry, including his experience as Chief Executive Officer, and a member of the board of directors, of Citigroup Inc. (NYSE: C), that Mr. Pandit should serve as a director. Committees: • Compensation and Talent Management; Nominating and Governance Business experience • Chairman and Chief Executive Officer, The Orogen Group LLC (July 2016 - present) • Chairman, TGG Group (February 2014 - June 2016) • Chief Executive Officer, Citigroup Inc. (December 2007 - October 2012) Public directorships during past five years • Director and member of the nominating and governance and finance committees, Virtusa Corporation (NASDAQ: VRTU) (2017 - 2021) • Lead Independent Director, chair of the human resources and compensation committee and member of the corporate governance and nominating committee, former member of the audit committee, Bombardier Inc. (TSX: BBD) (2014 - 2021) Other relevant experience • Director, Citigroup Inc. (December 2007 - October 2012) • Director, Fair Square Financial Holdings (2017 - 2021) • Director, Westcor Land Title Insurance Company (2020 - present) • Chairman, JM Financial Credit Solutions Ltd. (2014 - present) • Member of the Board of Overseers of Columbia Business School • Member of the Board of Visitors of Columbia School of Engineering and Applied Science | |||||

| SKILLS | ||||||

| Finance and accounting | |||||

| Executive leadership (within the last 5 years) | |||||

| Public company governance | |||||

| Analytics | |||||

| Human capital management | |||||

| Digital operations and solutions | |||||

| Global experience | |||||

| Mergers and acquisitions | |||||

/ | EXL |

Our board of directors

Thomas Bartlett Director since March 2024 | Independent |

| Age: 66 — is a seasoned business executive with extensive experience in technology and management of real estate. Mr. Bartlett’s business experience, skills and directorships are detailed below. The Company has concluded, based in part on Mr. Bartlett’s experience as the former Chief Executive Officer of American Tower Corporation, as well as his prior executive experience at Verizon Communications, that Mr. Bartlett should serve as a director. Committees: • Audit*; Nominating and Governance Business experience • Former Chief Executive Officer of American Tower Corporation (2020-2023); Executive vice president and chief financial officer (2009-2020); Treasurer (July 2017-Nov. 2018, 2012-2013) • Various operations and business development roles with predecessor companies and affiliates, including most recently senior vice president and corporate controller, Verizon Communications (1984-2009) • Began career at Deloitte, Haskins & Sells Public directorships during past five years • Director and member of the audit committee and the compensation committee, Otis Worldwide Corporation (NYSE: OTIS) (2023-present) • Director and member of the audit committee and chair of the finance committee, Equinix, Inc. (Nasdaq: EQIX) (2013-2021) • Director, American Tower Corporation (NYSE: AMT) (2020-2023) Other relevant experience • Member, Business Roundtable • Member, Board of Advisors of the Rutgers Business School • Member, Samaritans Advisory Council • Former member, Massachusetts Institute of Technology Presidential CEO Advisory Board • Former member, World Economic Forum’s Information and Communications Technology Board of Governors • Former member, National Association of Real Estate Investment Trust (NAREIT) Executive Committee | |||||

SKILLS | ||||||

| Finance and accounting | |||||

| Executive leadership (within the last 5 years) | |||||

| Public company governance | |||||

| Human capital management | |||||

| Digital operations and solutions | |||||

| Global experience | |||||

| Risk oversight and management | |||||

| Mergers and acquisitions | |||||

* Audit committee financial expert under applicable SEC rules and regulations.

| EXL 2024 Proxy Statement | / | 19 |

Our board of directors

Andreas Fibig Director since January 2023 |

|

|

Age:

Committees: •

Business experience

• Chairman and Chief Executive Officer, International Flavors & Fragrances, Inc., a food ingredients, beverage, scent, healthcare and biosciences company (2014 - 2022)

• President and Chairman of the Board of Management, Bayer Healthcare Pharmaceuticals, LLC a global pharmaceutical company (2008 - 2014)

• Senior Vice President/General Manager and various leadership positions, Pfizer, Inc., a multinational pharmaceutical and biotechnology company (2000 - 2008))

Public directorships during past five years

• Director, International Flavors & Fragrances, Inc. (2011 - 2022, Chairman from 2014 - 2022)

• Independent director and member of the research and development committee, former member of the audit committee, Novo-Nordisk A/S (NYSE: NVO), a global healthcare company (2018 - present)

• Independent director and member of the audit committee and finance and risk policy committee, Bunge Limited (NYSE: BG), a global agribusiness and food company (2016 - 2018)

Other relevant experience

• Chairman, Simtra (formerly Baxter Bioscience), a pharmaceutical contract development and manufacturing organization (2023 - present) • Director, Indigo Agriculture, an agricultural technology company (2022 - present)

• Director, EvodiaBio, a bioindustrial aroma company (2022 - present) | ||||||||

SKILLS | |||||||||

| Executive leadership (within the last 5 years) | ||||||||

|

| ||||||||

| |||||||||

| |||||||||

|

| ||||||||

| |||||||||

| |||||||||

|

Our board of directors

|

|

|

| |||||

|

| |||||

|

| |||||

| Public company governance | |||||

| Human capital management | |||||

| Marketing | |||||

| Global experience | |||||

|

| |||||

| ||||||

| ||||||

/ | EXL |

Our board of directors

Kristy Pipes Director since January 2021 |

|

|

Age:

Committees:

• Audit (Chair)*; Compensation and Talent Management

Business experience

• Chief Financial Officer, member of the Management Committee and various leadership positions, Deloitte Consulting LLP, a management consulting firm (1999 - 2019)

• Vice President and Manager, Finance Division, Transamerica Life Companies (1997 - 1999)

• Senior Vice President and Chief of Staff for the President and CEO, among other senior management positions, First Interstate Bank of California (1985 - 1996)

Public directorships during past five years

• Director and chair of the audit committee, and member of the nominating, governance and sustainability committee, Public Storage (NYSE: PSA), an international self storage company

• Director and chair of the audit committee, AECOM (NYSE: ACM), an international infrastructure consulting firm (2022 - present)

• Director and member of the nominating, governance, and sustainability committee, Savers Value Village (NYSE: SVV) one of the world’s largest thrift retailers (2023 - present) • Director and chair of the audit committee, and member of the nominating/corporate governance committee, PS Business Parks, Inc. (NYSE: PSB), a commercial property real estate investment trust (2019 - 2022)

| ||||||||

SKILLS | |||||||||

|

Finance and accounting | ||||||||

| Executive leadership

| ||||||||

| Public company governance | ||||||||

| Analytics | ||||||||

| Human capital management | ||||||||

| Global experience | ||||||||

| Risk oversight and management | ||||||||

| Information and cybersecurity | ||||||||

* Audit committee financial expert under applicable SEC rules and regulations.

| EXL | / |

Our board of directors

Nitin Sahney Director since January 2016

| Independent |

|

Age:

Committees:

• Nominating and Governance (Chair);

Business experience

• Founder, Member-Manager and Chief Executive Officer, PharmaCord, LLC, a company that helps biopharma manufacturers address product access hurdles (2016 - present)

• Operating Advisor, Clayton Dubilier & Rice Funds, a private equity firm (2016 - 2017)

• President and CEO (2014 - 2015) and President and COO (2012 - 2014) of Omnicare Inc., a former New York Stock Exchange-listed Fortune 500 company in the long-term care and specialty care industries

• Manager of a healthcare investment fund (2008 - 2010)

• Founder and CEO of RxCrossroads, a specialty pharmaceutical company (2001 - 2007)

• Prior leadership positions with Cardinal Healthcare, a global healthcare services and products company

Public directorships during past five years

• Director and member of the audit committee and the nominating and governance committee, Option Care Health, Inc. (NASDAQ: OPCH) (2019 -

Other relevant experience

• Member of the Board of Trustees, University of Louisville (2016 - 2019) | |||||

| SKILLS | ||||||

|

Finance and accounting

| |||||

| Executive leadership (within the last 5 years) | |||||

| Public company governance | |||||

| Mergers and acquisitions | |||||

* Audit committee financial expert under the applicable SEC rules and regulations

/ | EXL |

Our board of directors

Jaynie Director since September 2018

|

|

|

Age:

Committees:

• Compensation and Talent Management (Chair), Audit*

Business experience

• Chief Operating Officer, Overture Services, a pioneer in paid search and search engine marketing

• President & Chief Operating Officer, PayMyBills, the leading consumer bill payment and presentment company (1999 - 2001)

• Previously for over two decades served as Executive Vice President and Head of Consumer and Business Banking for three of the nation’s largest banks at the time and primarily for First Interstate of California. Today, these three banks form the backbone of Chase’s and Wells Fargo’s consumer business in California following the era of bank consolidation.

• Management Consultant, Booz, Allen & Hamilton

Public directorships during past five years

• Director and chair of the compensation committee and member of the risk management committee, Pacific Premier Bancorp (Nasdaq: PPBI), a top performing regional bank

• Director and member of the contracts committee, audit committee and nomination and governance committee, Western Asset Management funds, a major global fixed income fund, and director of affiliated funds for Western Asset Management (2004 - present)

• Director and chair of the compensation committee and member of the nominating and governance committee, CoreLogic, Inc. (NYSE: CLGX) until its acquisition in 2021 (2012

Other relevant experience • Director, compensation committee chair and member of the compliance committee, Pinnacle Entertainment (Nasdaq: PNK) until its acquisition in 2018 (2012 - 2018)

• Member of the National Association of Corporate Directors (“NACD”) Directorship 100, 2021, as one of the top public company directors in the U.S.; Named to Women Inc.’s 2019 Most Influential Corporate Directors listing

• Board chair emeritus and life trustee, Huntington Health, an affiliate of Cedars Sinai Health

• Trustee and board member, and member of the finance, audit and compensation committees, J. Paul Getty Trust | |||||

SKILLS | ||||||

| Finance and accounting

| |||||

| Executive leadership | |||||

| ||||||

| Public company governance | |||||

| Analytics | |||||

| ||||||

| Human capital management | |||||

| Digital operations and solutions | |||||

|

| |||||

| ||||||

experience | ||||||

| Risk oversight and

| |||||

| ESG | |||||

| Mergers and

| |||||

* Audit committee financial expert under applicable SEC rules and regulations.

| EXL | / | |

Our board of directors

Sarah K. Williamson Director since June 2023 | Independent |

| Age: 60 — is a leader in the global financial services and investment industries. Ms. Williamson’s business experience, skills and directorships are detailed below. The Company has concluded, based in part on Ms. Williamson’s experience as the Chief Executive Officer FCLTGlobal, as well as her prior experience at Wellington Management Company, LLP and her expertise in the global financial services and investment industries, that Ms. Williamson should serve as a director. Committees: • Audit*; Nominating and Governance Business experience • Chief Executive Officer, FCLTGlobal, a not-for-profit organization dedicated to encouraging long-term behaviors in business and investment decision-making (2016 - present) • Partner, Global Director of Alternative Investments, among other senior positions, Wellington Management Company LLP, a private independent investment management firm (1995 - 2016) • Senior Consultant, McKinsey & Company (1989-1994) Public directorships during past five years • Director and member of the audit committee and the compensation committee, Evercore (NYSE: EVR), a public investment bank (2018 - present) Other relevant experience • Board chair, Whitehead Institute for Biomedical Research, a non-profit research institution at the Massachusetts Institute of Technology • Member of the board, MITIMCo, the Massachusetts Institute of Technology Investment Management Company • Member of the board, Women’s Foundation of Boston • Member, Council on Foreign Relations, an independent American think tank focused on international relations and U.S. foreign policy | |||||

| SKILLS | ||||||

| Finance and accounting | |||||

| Executive leadership (within the last 5 years) | |||||

| Public company governance | |||||

| Global experience | |||||

| Risk oversight and management | |||||

| ESG | |||||

| Mergers and acquisitions | |||||

* Audit committee financial expert under applicable SEC rules and regulations.

| 24 | / | EXL 2024 Proxy Statement |

Corporate governance

Corporate governance

Director independence

In determining director independence, the board of directors considered the transactions and relationships set forth below under “Certain Relationships and Related Person Transactions—Related Party Transactions” and routine service arrangements between the Company and Westcor Land Title Insurance Company (“Westcor”). During 2022,2023, one of our directors, Mr. Pandit, served as a non-executive director and, through his ownership in The Orogen Group (see below for information on Mr. Pandit’s relationship with The Orogen Group), owned an immaterial indirect equity interest, in Westcor. Mr. Pandit is not, and was not during 2022,2023, a partner, controlling shareholder or executive officer of Westcor.

Based on its review of all applicable relationships, our board of directors has determined that all of the members on our board of directors, other than Mr. Kapoor, meet the independence requirements of the Nasdaq Stock Market and federal securities laws.

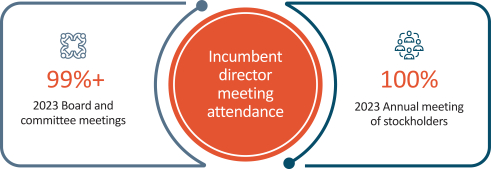

Meeting attendance

We expect our directors to attend all board of directors meetings and meetings of committees on which they serve. We also expect our directors to spend sufficient time and meet as frequently as necessary to discharge their responsibilities properly. It is our policy that all of our directors standing for election should attend our Annual Meetings of Stockholders absent exceptional cause.

Incumbent director meeting attendance

Board and committeeCommittee meetings in 20222023

|

|

|

|

|

|

| ||||||||||||

| Board meetings | Audit Committee meetings | Compensation and Talent Management Committee meetings | Nominating and Governance Committee meetings | |||||||||||||||

| 5 | 7 | 5 | 5 | |||||||||||||||

|

| EXL 2024 Proxy Statement | / | 25 |

Corporate governance

Corporate governance framework

TheOur board is responsible for providing governance and oversight over the effectiveness of policy and decision-making with respect to the strategy, operations and management of EXL, in order to enhance our financial performance and stockholder value over the long term.

Our board’s commitment to strong corporate governance is informed by the five core values of our corporate culture: innovation, respect, integrity, excellence and collaboration. Our board seeks to maintain best practices in corporate governance by reviewing and updating our governance policies, as appropriate, at least annually, and provides oversight over our risk management and strategic planning as relates to our growth, human capital management, and environmental, social and governancesustainability matters, each as discussed further below.

Governance policies

Our Corporate Governance Guidelines and other governance policies, including our committee charters and Code of Conduct and Ethics, codify our corporate governance framework.

| |||||||||||

The Corporate Governance Guidelines address Board responsibilities and conduct, director qualifications and membership matters, director orientation and continuing education, Board and committee meetings, and |

Our Code of Conduct and Ethics is applicable to our directors, officers and

| ||||||||||

| |||||||||||

Our committee charters specifically set out the authority and responsibilities of the Committees of the board.

| |||||||||||

| |||||||||||

/ | EXL 2024 Proxy Statement | |

Corporate governance

Beyond the board room

Director onboarding | Director continuing education | |||||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||

|

| All new directors participate in an orientation program shortly after their election or appointment, which is overseen by the Nominating and Governance Committee. New directors |

| We encourage our directors to participate in director continuing education (“DCE”): • We provide reimbursements for participation in DCE courses | ||||||||||||||||||||||||||||

|

| participate in site visits and presentations by

• strategic and business plans

• significant financial, accounting and risk

• compliance programs, and

• corporate governance framework. | ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||

| engage with our employees, stakeholders and community members directly. •

• | |||||||||||||||||||||||||||||||

| ||||||||

|

| |||||||

• We provide regular updates to our directors on corporate governance and ESG matters, executive compensation developments and trends, accounting standards changes, risk management matters and other legal and other topics of interest from a variety of internal and external sources.

Our directors are active DCE participants: For example, in

• attended

• participated in over

• received an NACD Cybersecurity certification following her participation in the NACD’s course on Cybersecurity led by Carnegie Mellon University.

In 2023, while visting our India offices, our directors had the opportunity to meet with NASSCOM leadership to discuss a wide range of industry-related topics. In addition, Ms. Williamson attended the Stanford University Directors’ College in June 2023. Certain of our directors are also involved in industry-level or general governance matters. For example:

•Ms. Williamson’s work as the CEO of FCLTGlobal involves assisting the boards of directors of its member companies with governance matters and investor-corporate engagement, among others. • Mr. Mittal is the former president and chairman of the National Association of Software and Service Companies (“NASSCOM”), an Indian trade association and governance group focused on the information technology and business process outsourcing industry, in which we, and many of our U.S. peer companies with operations in India, are members. He advises NASSCOM on best practices for corporate governance and is currently assisting NASSCOM in the development of data privacy legislation in India.

| ||||||||

Employee engagement | ||||||||||||||||||||||||||||

| Our directors are generally invited to visit any EXL office and have complete and open access to our management and employees. | |||||||||||||||||||||||||||

| They also take part in EXL company initiatives in • In 2023, our directors had several • In January 2024, Ms. Williamson | |||||||||||||||||||||||||||

|

|

|

|

|

|

| ||||||||

| Kristy Pipes Independent director |

|

Independent | Som Mittal Independent director | Jaynie Studenmund Independent director |

|

| EXL 2024 Proxy Statement | / | 27 |

Corporate governance

Board leadership structure

|

| Our board of directors is currently led by Rohit Kapoor, our Chair and CEO, and Vikram Pandit, our

| ||||

Rohit Kapoor Chair and CEO | Vikram Pandit Lead Director | |||||

Consolidating

Our Sixth Amended and Restated By-laws (our “By-laws”) provide that our Chair or, in the Vice Chairmanabsence of our Chair, our Lead Director, or in the absence of both our Chair and Lead Director, our CEO, calls meetings of our board of directors to order and acts as the chair for those board meetings. In the absence of our Chair, our Lead Director, and our CEO, a majority of our directors present may elect as chair of the meeting any director present. Independent directors meet at least quarterly in executive session without any management directors or members of the Company’s management present. Our Corporate Governance Guidelines provide that in the absence of our Chair, our Lead Director or, in the absence of the Lead Director, a director chosen by the directors meeting in executive session, presides at all executive sessions.

The board of directors does not have a permanent policy or practice regarding the combination of the Chair and CEO role. At present, the board believes that consolidating the Chair and CEO positions allows our CEO to contribute his experience and perspective regarding management and leadership of the Company towards the goals of improved corporate governance and greater management accountability. In addition,This structure also provides greater information flow between the management team and directors. At the same time, the presence of our ChairmanLead Director ensures that the board can retain sufficient delineation of responsibilities, such that our ChairmanLead Director and our Vice ChairmanChair and CEO may each successfully and effectively perform and discharge their respective duties and, as a corollary, enhance our prospects for success. As a result, the Company will benefitbenefits from the ability to integrate the collective leadership and corporate governance experience of our ChairmanLead Director and our Vice ChairmanChair and CEO, while retaining the ability to facilitate the functioning of the board of directors independently of our management and to focus on our commitment to corporate governance.

For the foregoing reasons, our board of directors has determined that its leadership structure is appropriate and in the best interests of our stockholders at this time.

/ | EXL 2024 Proxy Statement | |

Corporate governance

Director qualifications, refreshment and evaluations

Director qualifications

|

Key skills and attributes we look for in board nominees

|

The board of directors considers it paramount to achieving excellence in corporate governance

to assemble a board of directors that, taken together, has the breadth of skills, qualifications, experience and attributes appropriate for functioning as the board of our Company and working productively with management. The Nominating and Governance Committee of the board is responsible for recommending nominees who are qualified and bring a diverse set of skills and qualifications to oversee the Company effectively.

The Nominating and Governance Committee has not formally established any minimum qualifications for director candidates, but pursuant to our Corporate Governance Guidelines, our board seeks independent directors from diverse professional and personal backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity. The board believes that its membership should reflect a diversity of gender, race, ethnicity, age, and skills and experience in the context of the needs of the board and endeavors

to consider such criteria, when applicable, for positions on the board. The Nominating and Governance Committee assesses each director candidate on this basis. The Nominating and Governance Committee considers a number of factors in selecting director candidates, including, among others: ethical standards and integrity; independence; diversity of professional and personal backgrounds; skills and experience; other public company directorships; and financial literacy and expertise; communication skills; and ability and willingness to comply with Company policies and procedures.

In light of our business, the primary areas of experience, qualifications and attributes typically sought and put forward by the Nominating and Governance Committee in director candidates include, but are not limited to, the following:

|

Executive leadership Experience holding significant leadership positions, including as a CEO or head of a significant business, to help us drive business strategy, growth and performance. | |||

|

Finance and accounting Experience with finance, accounting or financial reporting processes, to help drive financial performance. | |||

| ||||

| Global companies Experience working outside of the United States or with multinational companies, to help facilitate our global expansion. | |||

|

| EXL 2024 Proxy Statement | / | 29 |

Corporate governance

| Board experience Understanding of public company board of director and fiduciary duties, to help provide perspective on corporate governance best practices and related matters. | |||

|

Experience with data analytics, digital operations and solutions, artificial intelligence and machine learning, and other key technologies that are central to our business.

| |||

| Client and industry knowledge Experience with our key client industries, including insurance, healthcare, banking and financial services, finance/accounting, and our other capabilities, to help deepen our knowledge of our key industry verticals and markets in which we do business. | |||

| ||||

| Risk oversight/management Experience assessing and overseeing the overall risk profile of multinational public companies.

| |||

| Human capital management Experience in management and development of human capital, including management of a large workforce, diversity and inclusion, talent development, workplace health and safety, compensation and other human capital issues. | |||

| ||||

| Diverse backgrounds We seek directors with diverse professional and personal backgrounds and perspectives to promote the values of diversity and inclusion from the top and to provide perspective from varying viewpoints. | |||

|

Experience in Experience in managing | |||

| ||||

| Information and cybersecurity Experience in information and cybersecurity matters, best practices and associated risks.

| |||

|

Mergers and acquisitions Experience in mergers and acquisitions as a component of business development and strategy. | |||

| ||||

|

Marketing Experience in marketing and branding of multinational companies. | |||

/ | EXL 2024 Proxy Statement | |

Corporate governance

Refreshment

Our Nominating and Governance Committee

Considerations include whether the composition of the board of directors (and its committees) includes sufficient diversity and independent skill sets and background as appropriate for our immediate and long-term strategic needs. These considerations are also informed by discussions with our investors through stockholder engagement. In terms of diversity, our board, following the Annual Meeting will be

|

Board refreshment

| |||||

ADDITIONS

|

EXITS

| |||||

|

| |||||

2023 Andreas Fibig Sarah K. Williamson |

2023

Anne Minto Clyde Ostler

| |||||

While the Company does not maintain term limits, our Corporate Governance Guidelines provide that the expectationsexpectation for new directors is a maximum term of ten years. Each of our director nominees, other than Mr. Kapoor, our Vice ChairmanChair and CEO, has served on the board for less than ten years as of the date of this Proxy Statement. The board actively manages board refreshment and succession planning at the board and committee level. For example, the board generally expects that each member serve on two committees, and that each committee chair serve for a maximum of five years. The board expects that over the next few years, the committee and board composition will continue to change due to rotation and retirement. The Nominating and Governance Committee will identify successors based on the goal of maintaining the board’s overall balance of experience and perspective. A recommendation regarding board (and committee) composition is shared with the full board of directors on an annual basis.

| EXL 2024 Proxy Statement | / | 31 |

Corporate governance

Board refreshment process

/ | EXL |

Corporate governance

Board refreshment process

|

Corporate governance

Committee rotation

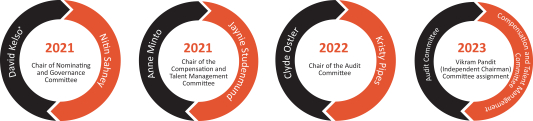

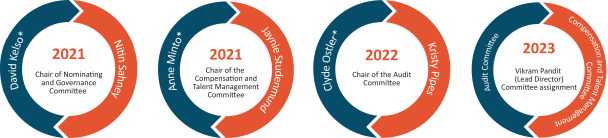

We rotate committee and committee chair assignments based on the current composition of the board. Recent rotations include the following:

* Former director

Board evaluations

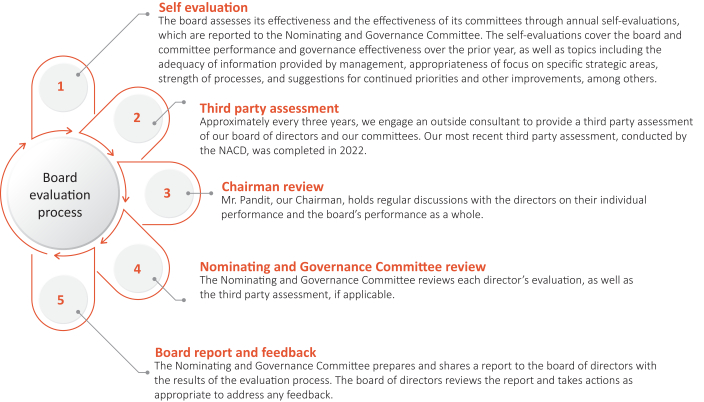

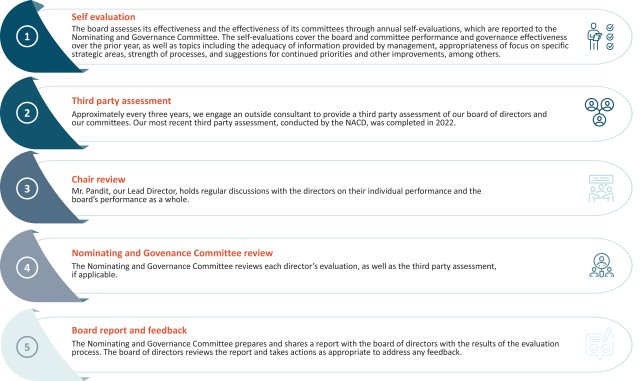

We consider the continued effectiveness of the board and its committees as critical to our long-term success and stockholder value. The board evaluates its performance and the performance of itits committees and each director on an annual basis through the following process:

|

| EXL 2024 Proxy Statement | / | 33 |

Corporate governance

Succession planning

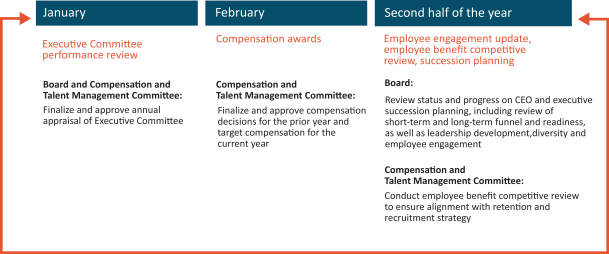

Our board of directors (without the participation of the CEO), guided by our Lead Director, is responsible for developing and annually reassessing succession plans for our CEO and other key executive officers of the Company, and preparing contingency plans for interim CEO succession in the event of an unexpected occurrence for board review. In addition, our Compensation and Talent Management Committee is responsible for ensuring appropriate compensation strategies and design to align with the retention and recruitment of our key executive officers. We actively plan for the succession of our executive officers (including those who are retiring or departing from the Company), and regularly consider our strong pipeline of internal and external candidates. As part of this process, in April 2024, Vikas Bhalla and Vivek Jetley, who had been serving as Executive Vice President and Business Head, Insurance and Executive Vice President and Business Head, Analytics, respectively, were each promoted to President of EXL in addition to their business head roles. In their expanded roles, they will take on broader Company-wide responsibilities, including supporting our Chair and CEO to drive overall corporate performance and the adoption of our data and AI-led solutions. We generally consider succession planning and associated executive compensation matters on the following schedule:

Committees

Our board of directors currently has three standing committees: the Audit Committee, the Compensation and Talent Management Committee and the Nominating and Governance Committee. As discussed above, our board of directors has determined that each member of the Audit, Compensation and Talent Management and Nominating and Governance Committees meets the independence and experience requirements of the Nasdaq Stock Market and federal securities laws. Copies of our committee charters can be found on the Investor Relations page of our website at: https://ir.exlservice.com/corporate-governance. Information on our website referred to in this Proxy Statement does not constitute a part of this Proxy Statement.

| 34 | / | EXL 2024 Proxy Statement |

Corporate governance

The following table sets forth the current chairs and members of each standing committee of the board of directors. As an executive director, Mr. Kapoor, our Chair and CEO, does not serve on any board committee.

Audit | Compensation and | Nominating and | ||||||

Vikram Pandit |  |  | ||||||

Thomas Bartlett * |  |  | ||||||

Andreas Fibig |  |  | ||||||

Som Mittal* |  |  | ||||||

Kristy Pipes*

|  |  | ||||||

|  |  | ||||||

|  |   |

| |||||

Nitin Sahney

|   |

|  | |||||

Jaynie Studenmund*

|   |  |

| |||||

|  |

|  |  | ||||

|  |  | ||||||

|  |   | ||||||

|

Committee Chair

|   |

Member

|

*Not standing for re-election

*Audit Committee Financial Expert

| EXL | / | |

Corporate governance

Audit Committee

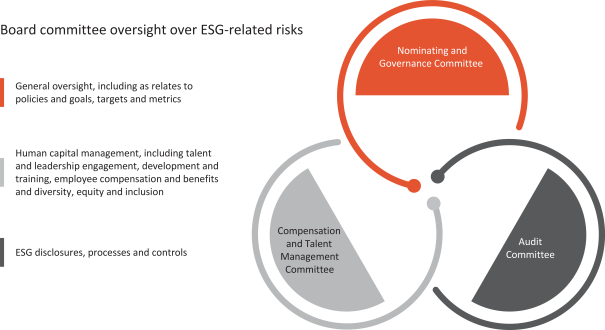

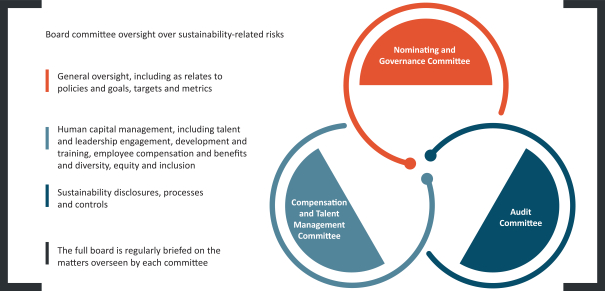

Our Audit Committee oversees and assists our board of directors in fulfilling its oversight responsibilities with respect to our accounting and financial reporting processes, including the integrity of the financial statements and other financial information provided by us to our stockholders, the public, stock exchanges and others; our compliance with legal and regulatory requirements; our independent registered public accounting firm’s qualifications and independence; the audit of our financial statements; the performance of our internal audit function and independent registered public accounting firm; and the Company’s cybersecurity program and cyber strategy-related risks; business continuity and disaster recovery planning; our Code of Conduct and ESG-relatedEthics and the processes used to disseminate it to our employees and monitor their compliance with our Code of Conduct and Ethics; and environmental, social and governance-related disclosure, processes and controls. Our Audit Committee’sIts risk oversight is discussed below beginning on page 43.39. Our Audit Committee charter permits the committee to form and delegate authority to subcommittees when appropriate, provided that the subcommittees are composed entirely of directors who satisfy the applicable requirement of federal securities laws as well as independence requirements of the Nasdaq Stock Market.

Our Audit Committee has direct responsibility for the appointment, compensation, retention (including termination) and oversight of our independent registered public accounting firm, and our independent registered public accounting firm reports directly to our Audit Committee. Our Audit CommitteeIt also reviews and approves specified related-party transactions as required by the rules of the Nasdaq Stock Market, and oversees the Company’s cybersecurity program and cyber strategy-related risks. The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (the “Exchange Act”). Our Audit Committee annually reviews and assesses the adequacy of the Audit Committeeits charter and its own performance.

The members of our Audit Committee are appointed by our board of directors. All members of our Audit Committeethe committee must also be recommended by our Nominating and Governance Committee.

Audit Committee profile

| ||

Kristy Pipes, Chair*

Thomas Bartlett* Andreas Fibig

Jaynie Studenmund* Sarah K. Williamson*

|

| |

• Accounting and financial reporting processes

• Our independent registered public accounting firm’s appointment and independence

• The audit of our financial statements and internal audit function

• Other key areas including cybersecurity, ESG disclosures, processes and controls, litigation, business continuity and disaster recovery, compliance and regulatory enforcement matters

| ||

*Audit committee financial expert under applicable SEC rules and regulations

| ||

7 committee meetings in

| ||

/ | EXL |

Corporate governance

Compensation and Talent Management Committee

Our Compensation and Talent Management Committee reviews and recommends policies relating to compensation and benefits of our directors, officers and employees and is responsible for approving the compensation of our Vice ChairmanChair and CEO and other executive officers, as well as our employee benefitbenefits policies, programs and administration. Our Compensation and Talent Management CommitteeThe committee reviews, evaluates and makes recommendations to our board of directors with respect to our incentive compensation plans and equity-based plans and administers the issuance of awards under our equity incentive plans. Our Compensation and Talent Management CommitteeIt also provides oversight with respect to human capital management matters, including diversity, equity and inclusion, and talent and leadership engagement, development and training and, in 2022, changed its name from Compensation Committee to Compensation and Talent Management Committee to reflect these responsibilities. Our Compensation and Talent Management Committeetraining. The committee’s charter permits the committee to form and delegate authority to subcommittees when appropriate, provided that the subcommittees are composed entirely of directors who satisfy the applicable independence requirements of the Nasdaq Stock Market.

OurThe Compensation and Talent Management Committee charter also permits the committee to retain advisors, consultants or other professionals to assist the Compensation and Talent Management Committeecommittee to evaluate director, Vice ChairmanChair and CEO or other senior executive compensation and to carry out its duties. For 2022,2023, our Compensation and Talent Management Committee retained the services of Farient Advisors LLC (“Farient”), a qualified and independent compensation consultant, to aid the Compensation and Talent Management Committeecommittee in performing its review of executive compensation including executive compensation benchmarking and peer group analysis. Our Compensation and Talent Management Committee annually reviews and assesses the adequacy of the Compensation and Talent Management Committeeits charter and its own performance. Additional information regarding our Compensation and Talent Management Committee’s processes and procedures for considering executive compensation are addressed in the Compensation Discussion and Analysis below.

Compensation and Talent Management Committee profile

| ||

Jaynie Studenmund, Chair Som Mittal

Vikram Pandit Kristy Pipes

|

| |

• Overall compensation risk management, including recommending incentive compensation plans

• Retention of advisors or other compensation consultants

• Oversight of human capital management matters, including diversity, equity and inclusion

• No interlocks or insider participation

| ||

| ||

The members of our Compensation and Talent Management Committee are appointed by our board of directors. All new members of our Compensation and Talent Management Committeethe committee must be recommended by our Nominating and Governance Committee.

During 2022,2023, none of our executive officers served as a member of the board of directors or Compensation and Talent Management Committee ofcompensation committee (or similar) of any entity that has one or more executive officers who serve on our board of directors or Compensation and Talent Management Committee.

| EXL | / | |

Corporate governance

Nominating and Governance Committee

Our Nominating and Governance Committee is responsible for: (i) identifying and recommending candidates for election to our board of directors using selection criteria approved by our board of directors, reviewing composition of the board and committee membership and overseeing board refreshment and director compensation and benefits matters, (ii) developing and recommending to our board of directors Corporate Governance Guidelines, including independence standards, and other board procedures or corporate governance policies, as well as any changes to such guidelines, procedures or policies or to any of our organizational documents; (iii) overseeing our board of director and management evaluations and our director education program, and (iv) overseeing our ESGenvironmental, social and governance-related goals, policies and practices. Our Nominating and Governance CommitteeThe committee’s charter permits the committee to form and delegate authority to subcommittees when appropriate, provided that the subcommittees are composed entirely of directors who satisfy the applicable independence requirements of the Nasdaq Stock Market.

Nominating and Governance Committee profile

| ||

Nitin Sahney, Chair

Thomas Bartlett Andreas Fibig

Som Mittal Vikram Pandit Sarah K. Williamson

|

| |

• Reviewing composition of the board, overseeing board refreshment and identifying and recommending board candidates

• Developing and recommending governance practices, including our Corporate Governance Guidelines

• Overseeing board evaluations

• Overseeing our ESG goals, policies and practices

| ||

| ||

Our Nominating and Governance Committee reviews written and oral information provided by and about candidates and considers any additional criteria it feels isare appropriate to ensure that all director nominees possess appropriate skills and experience to serve as a member of our board of directors.

The Nominating and Governance CommitteeIt also oversees our director onboarding and training program, which provides new directors with training regarding the Company’s policies and procedures and specific requirements that may be needed based on the director’s committee memberships.

In addition, the Nominating and Governance Committee oversees and reviews the Company’s ESG goals, policies and programs and the Company’s corporate governance policies and practices regularly. Our Nominating and Governance CommitteeIt is responsible for reviewing and assessing the adequacy of our organizational documents, and recommending any changes as well asand annually reviewing and assessing the adequacy of the Nominating and Governance Committeeits charter and its own performance. The members of our Nominating and Governance Committee are appointed by our board of directors.

/ | EXL |

Corporate governance

Board and committee oversight of risk management

| Full board oversight | |||||||||

| Our board of directors is ultimately responsible for overseeing EXL’s risk management activities as a whole. | |||||||||

Our management is responsible for development of our risk management framework and methodological guidelines. Management, and ultimately, our Chair and CEO, is responsible for our day-to-day risks, and, because we are exposed to financial risks in multiple areas of our business, day-to-day risk management activities and processes are performed by multiple members of our senior and other management.

| Our management assists the board in identifying strategic and operating risks that could affect the achievement of our business goals and objectives, assessing the likelihood and potential impact of these risks and proposing courses of action to mitigate and/or respond to these risks. |

| |||||||

| |||||||||||||||